Artificial Intelligence (AI) is reshaping the future of financial trading—bringing speed, accuracy, and intelligence to a once manually-driven process. As fintech continues to evolve at a rapid pace, trading platforms powered by AI are becoming the new standard for brokers, investors, and financial institutions.

In this comprehensive guide, we explore how AI is transforming trading platforms, the key technologies behind it, and what fintech innovators need to know to stay competitive in an increasingly data-driven market.

Why AI Is a Game-Changer in Trading

Traditional trading systems rely on human judgment, rule-based algorithms, and historical analysis. But financial markets move fast, are influenced by real-time sentiment, and require decisions in milliseconds. This is where AI comes in.

AI enables platforms to:

- Analyze massive datasets in real time

- Identify profitable patterns and anomalies

- Automate complex strategies

- Improve user experience with personalization

- Reduce risk through predictive modeling and fraud detection

Whether you’re a fintech startup or an established platform provider, integrating AI can dramatically enhance both performance and customer satisfaction.

Key Ways AI Is Transforming Trading Platforms

1. Real-Time Data Analysis and Pattern Recognition

AI can analyze thousands of data points – including market prices, volumes, news feeds, and social media – in real time. By spotting patterns and correlations humans would miss, AI helps traders make faster, smarter decisions.

Use case: AI models track high-frequency price movements to signal short-term trade opportunities, adapting to new data every second.

2. Predictive Analytics for Market Forecasting

Machine learning algorithms use historical and real-time data to forecast future price trends. These models constantly evolve, learning from new market behavior and adjusting predictions accordingly.

Benefit: Traders can anticipate potential market movements instead of reacting to them – maximizing profitability and minimizing risk.

3. Algorithmic Trading Automation

AI has revolutionized algorithmic trading by enabling platforms to execute trades based on dynamic conditions. These intelligent systems automatically buy or sell assets when predefined thresholds or AI-generated signals are triggered.

Result: Greater efficiency, reduced latency, and more consistent performance without emotional decision-making.

4. Sentiment Analysis Using Natural Language Processing (NLP)

AI can now understand human language through Natural Language Processing. Trading platforms can scan news articles, tweets, analyst reports, and other text-based sources to measure market sentiment.

Example: A surge in positive sentiment about a stock on social media can signal potential price movement before traditional indicators react.

5. Risk Management and Fraud Detection

AI enhances platform security and compliance by identifying unusual trading behaviors or suspicious activities in real time.

- Detect anomalies and prevent market manipulation

- Monitor portfolios and assess risk exposure instantly

- Generate alerts for abnormal trading volumes or patterns

This makes platforms more resilient and trustworthy for both retail and institutional users.

6. Personalized User Experience

AI helps deliver a more tailored trading experience by analyzing user behavior and preferences. From customized dashboards to intelligent trade recommendations, personalization drives user engagement and retention.

Examples of personalization:

- Smart watchlists

- Automated trade suggestions based on past performance

- Educational content based on user proficiency

7. Voice Assistants and Conversational AI

AI-powered chatbots and voice assistants are becoming common in fintech platforms. They offer real-time support, trade execution via voice, and quick access to insights or tutorials – improving customer service without increasing human resources.

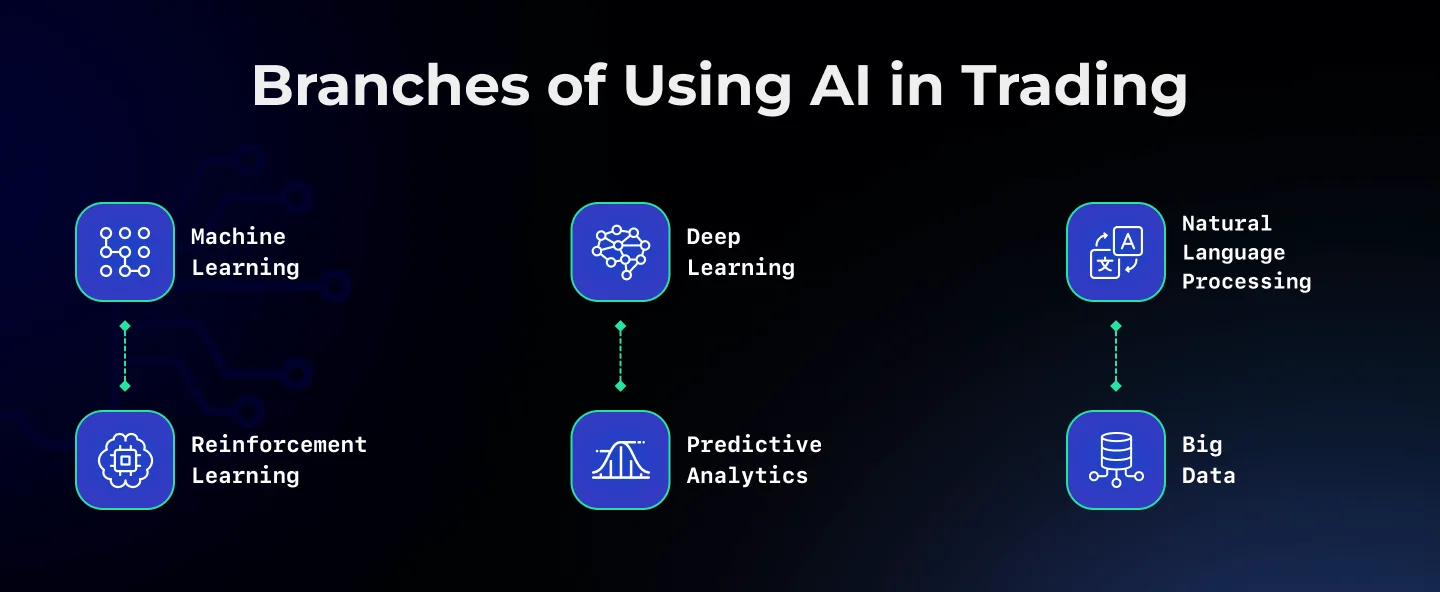

The Core Branches of Using AI in Trading

Artificial Intelligence isn’t a single tool – it’s an entire ecosystem of techniques that continuously evolve to tackle the complexities of financial markets. Each branch brings its own strengths, from uncovering hidden price patterns to analyzing market sentiment at scale. Here’s a closer look at the core AI disciplines transforming modern trading.

1. Machine Learning (ML)

Machine Learning is at the heart of most AI-driven trading solutions. These models learn from historical market data, statistical patterns, and real-time price fluctuations to make informed predictions. By continuously refining their algorithms with fresh data, ML systems become more accurate at identifying profitable entry and exit points over time.

2. Deep Learning

Deep Learning is a specialized subset of machine learning that uses multi-layered neural networks to detect highly complex patterns. In trading, deep learning models can process vast amounts of unstructured data—such as price charts, sentiment feeds, and economic indicators—to forecast market trends that simpler models might miss.

3. Natural Language Processing (NLP)

NLP focuses on interpreting human language. It’s particularly valuable for sentiment analysis, where the platform scans news articles, social media posts, and company reports to understand market mood. By quantifying positive or negative sentiment around assets or market events, traders gain an edge in anticipating price movements before they fully register on the charts.

4. Reinforcement Learning

Reinforcement Learning (RL) algorithms improve their trading strategies through trial and error in simulated or live market environments. These models receive “rewards” for profitable trades and “penalties” for losses, adjusting their strategy accordingly. Over time, RL-driven trading bots can self-optimize to consistently adapt to evolving market conditions.

5. Predictive Analytics & Big Data

Predictive analytics uses statistical techniques and large-scale data processing to forecast future price movements. By combining historical patterns with real-time market feeds, these tools help traders and fund managers gauge potential risks and returns. When integrated with AI, predictive analytics can uncover hidden correlations and provide early warnings for sudden market shifts.

Conclusion

Artificial Intelligence is more than a buzzword – it’s a transformative force reshaping how markets operate and how traders make decisions. By weaving together machine learning, deep learning, natural language processing, reinforcement learning, and predictive analytics, modern trading platforms have evolved to provide users with unprecedented levels of automation, accuracy, and insight. This shift toward AI-driven solutions is not just a technological upgrade it represents a new paradigm for finance itself.

Fintech innovators who embrace AI early can expect several advantages:

- Enhanced Profitability: AI’s pattern-recognition and predictive capabilities allow traders to seize opportunities quickly, often before human analysts even notice them.

- Robust Risk Management: Real-time data analysis and automated anomaly detection enable firms to spot signs of market manipulation or fraud more swiftly, protecting both capital and reputation.

- Scalable Solutions: As trading volumes grow, AI algorithms can handle increased loads without a corresponding spike in infrastructure costs, ensuring platforms remain responsive and reliable.

- User-Centric Development: By personalizing dashboards, alerts, and educational content, AI-powered platforms create deeper user engagement, ultimately building trust and brand loyalty.

- Continuous Evolution: AI learns from market feedback, adapting to new patterns and shifting trends. This means your platform can stay relevant in a rapidly changing financial environment – without the need for constant manual updates.

Looking to the future, it’s clear that AI will play an even bigger role in automating complex strategies, integrating multimodal data sources, and anticipating black swan events. For fintech providers, now is the time to invest in scalable, ethical, and secure AI frameworks that can keep pace with market evolution. By doing so, you’ll not only future-proof your platform but also equip your clients with the tools they need to thrive in an increasingly dynamic financial world.

In short, the key takeaway is straightforward: AI isn’t just enhancing trading it’s redefining it. As the fintech landscape grows ever more competitive, embracing these technologies will be the factor that separates industry leaders from those left behind. If you’re ready to harness the power of AI, start by identifying your platform’s unique needs, choosing the right data

Twitter

Linkedin

Facebook