The fintech industry has seen tremendous progress over the past years, and 2025 is poised to bring even more advancements. The increasing demand for digital financial services has significantly accelerated technological advancements, impacting numerous business sectors, including financial technologies.

The rapid expansion of the fintech industry has brought major opportunities along with challenges. The shift toward contactless transactions and remote services has become incredibly convenient and is now an integral part of our daily lives.

Unfortunately, the expansion of cyberspace has led to an increase in cybercrime. According to Statista, the overall financial damage caused by cybercrime has continued to rise, nearly doubling over the past two years as we move into 2025. Beyond financial losses, companies also suffer reputational damage and customer attrition. As financial services inherently involve sensitive data, it is imperative for companies to prioritize cybersecurity and protect customer information from cybercriminals.

The more fintech moves towards digital experiences, the more points of compromise appear. Every point of transaction or origination may become a target for a cyberattack. Increasingly, the risk of cyberattack does not come from the front door but through a side door – often through relationships that organisations have with other providers. Therefore, assessing and managing risks that may come through vendors in real time is increasingly important.

Let us have a look at the most common security risks and challenges that fintech faces.

Common Security Risks and Challenges in Fintech

Identity fraud and identity theft.

Fintech applications and websites collect sensitive information, making them prime targets for cybercriminals. Hackers use password-cracking techniques to gain access to users’ accounts and financial assets. Multi-factor authentication (MFA) has become a standard security measure to mitigate such risks.

Securing applications and networks.

Applications and networks form the backbone of fintech operations and are highly susceptible to cyberattacks. A compromised application can serve as a gateway to an entire network, making robust security measures essential.

Types of Cyberattacks:

Cybercriminals employ various attack strategies, including:

- Denial of Service (DoS) – Preventing legitimate users from accessing services by overwhelming networks with traffic.

- Phishing – Deceiving users into disclosing sensitive information by impersonating legitimate businesses.

- Ransomware – Encrypting critical files and demanding ransom payments to restore access.

Data Breaches. Fintech firms handle vast amounts of sensitive data. Daily transactions are vulnerable to hacking attempts, and regulatory bodies hold companies accountable for data breaches.

Money Laundering Risks. Fintech companies work with cryptocurrencies. Despite the largest benefit of anonymous transactions that cryptocurrencies offer, this may have a dark side to it when it comes to money laundering and crypto thefts done by cybercriminals.

Regulatory Compliance

Fintech companies must adhere to stringent regulations to protect customer data. Key compliance frameworks include:

- GDPR (General Data Protection Regulation) – A stringent data privacy law that mandates strong security controls.

- KYC (Know Your Customer) – A process to verify customer identities and prevent financial fraud.

- PCI DSS (Payment Card Industry Data Security Standard) – Security standards for handling card transactions.

- PSD (Payment Services Directive) – Regulations governing electronic payments in the EU.

Compliance with banking regulations. Due to the nature of financial industry, it has always been one of the most highly regulated areas. Dealing with money and having access to PII (Personally Identifiable Information), all operations of fintech companies are regulated by official bodies that require implementing data protection measures and are hold responsible should they fail to do so.

How to Mitigate Fintech Security Risks

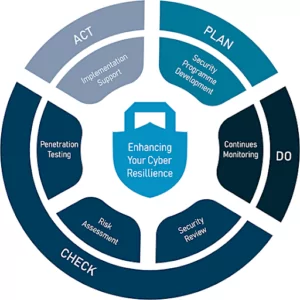

The role of cybersecurity in fintech is hard to underestimate. Cybersecurity is the key to creating a secure and truly successful product. In order to minimise the risks, fintech companies should prepare a cybersecurity program that will be able to secure networks and systems from attacks and prevent those attacks in the future. The Plan-Do-Check-Act process is a helpful tool for preventing risks like these.

1. Secure Networks and Infrastructure

Protecting your network and infrastructure from hackers’ attack is the first line of defense in cybersecurity. As an ever-evolving mechanism, cybersecurity should undergo regular reviews, updates and improvements to keep your company systems safe.

2. Strengthen Cloud Security

Fintech companies deal with large volumes of data and often use cloud services to store the information. Having cloud security strategy that is regularly reviewed and updated as new threats appear, will help organisations to minimise the risk of attacks.

3. Adopt a Security-First Approach in Development

Take a security-first approach when you develop an app. It enables to monitor and manage threats in real time using tools and techniques that protect stored data.

4. Conduct Penetration Testing

Before launching your app, run a penetration test that enables identify the app vulnerabilities and eliminate the risks of cyberattack. Penetration tests can be done at any stage of the app development, including the pre-launch stage.

5. Enhance Authentication Protocols

In fintech, user’s personal information is the most vulnerable point that can come at cost to fintech companies. Implement strong authentication method to protect your users’ identity and personal data that include strong passwords and multi-factor authentication process.

6. Obtain Cybersecurity Certifications

Certification may not guarantee full protection from cybercriminals; however, it will help your company to put cybersecurity risk management programme in place. The programme helps identify and manage vulnerabilities as well as assess third party risks.

7. Regular Security Reviews and Updates

Accept the fact that the moment you have your cybersecurity programme in place, you will need to check everything again. Regularly run checks and continuous reviews is part of the plan to keep you networks, systems and apps secure. Stay alert at all times and remember that the safety of your company is in your hands.

Conclusion

Cybersecurity plays a pivotal role in fintech, determining the success and sustainability of businesses. Protecting client data, networks, and systems is essential for maintaining trust and regulatory compliance. Implementing a comprehensive cybersecurity strategy can mitigate risks and ensure long-term success.

If you are unsure of how to protect your data, here at Fintatech, we stay on top of innovations and developments that help address critical needs in the area of cybersecurity. Get in touch with us and we can help with the right piece of advice on how to secure your company data.

Twitter

Linkedin

Facebook