Trading with digital assets is a powerful force sweeping through the entire financial services landscape, spurred on by innovation in blockchain technology. It involves buying and selling cryptocurrencies, tokens, and non-fungible tokens (NFTs), which are stored and transacted on decentralized ledgers. Digital asset trading, in contrast to traditional financial markets, allows for round-the-clock transactions of a group of people situated on a network around the globe, without intermediaries such as banks. From pioneer currencies like Bitcoin and Ethereum to novel utility and governance tokens, digital asset trading unlocks fresh ways of investment, speculation, and value exchange in a digital-first world.

What Is Digital Asset Trading?

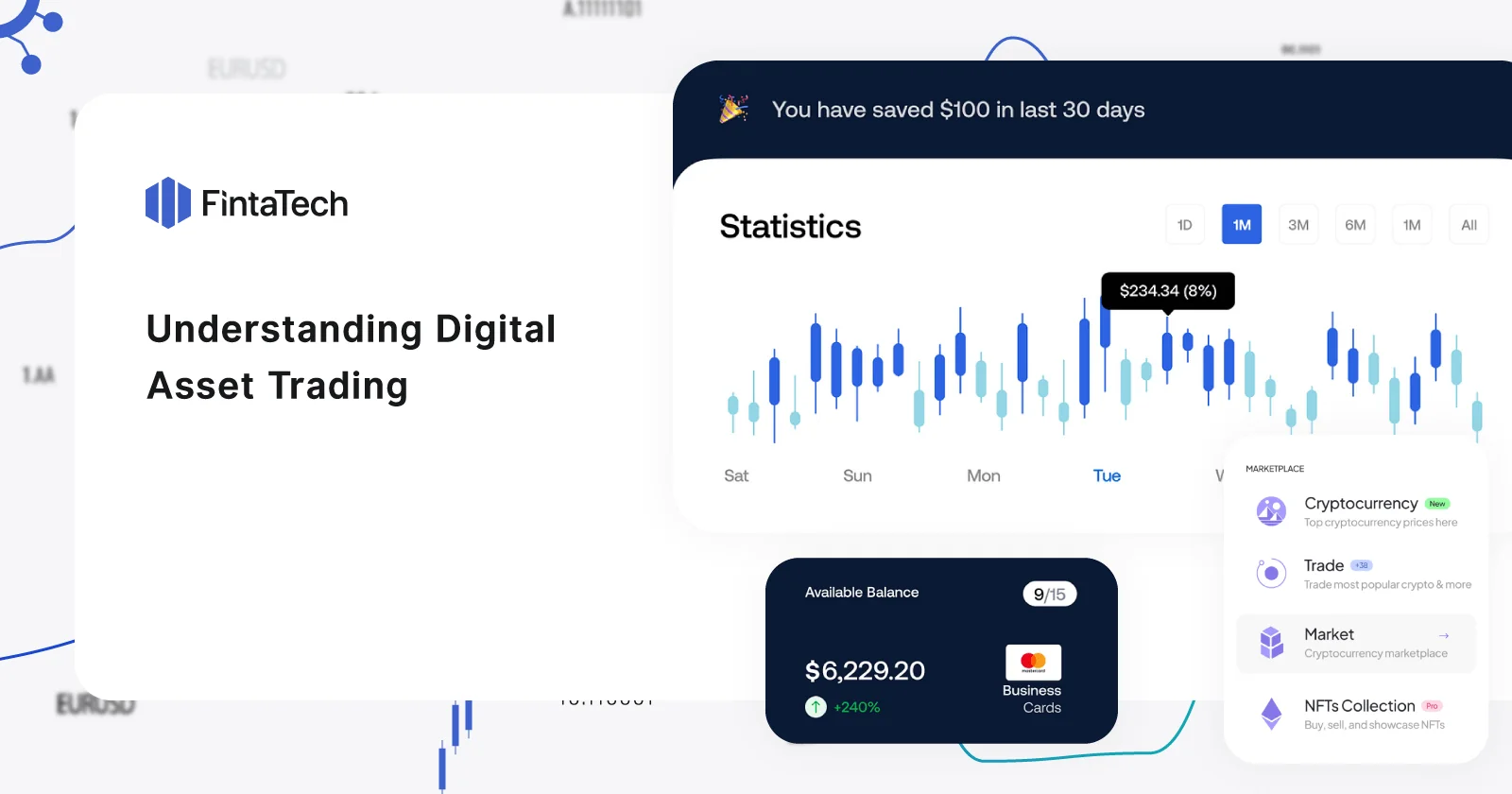

Digital asset trading is the process of buying and selling cryptocurrencies, tokens, and non-fungible tokens (NFTs) through online platforms or exchanges. Generally, these are created on blockchain technology, which provides a decentralized, secure ledger for recording all transactions. Trading is done on different kinds of trading platforms.

Centralized Exchanges (CEX): These are the traditional platforms that facilitate the buying and selling of assets. They buy and sell these digital assets against others, relying on the security, transaction handling, and custody of the platform.

Decentralized Exchanges (DEX): These allow direct peer-to-peer transactions without the need for an intermediary. Most work on blockchain technology using smart contracts to enable and automate trading. In many ways, digital asset trading is similar to regular financial trading but uses digital technology to boost the speed and possibly lower costs. Most traders apply different strategies in day trading, scalping, or swing trading, or they simply hold for a long period, like other financial markets. Key features include creating a digital wallet to store assets, understanding market orders (for example, market, limit, and stop orders), and managing risks in an environment of high volatility. The idea is to make profits from changes in the prices of assets, which are motivated by demand and supply market dynamics.

Importance of Digital Assets

Digital assets are quickly becoming an important part of the modern financial system, offering a new paradigm of how value is created, exchanged, and stored. Here are some key reasons why digital assets are important:

- Innovation in Financial Systems

Digital assets happen to be right at the front in terms of innovative financial systems. In this view, they challenge conventional financial models, often taken for granted. This has enabled new decentralized options for people beyond the legacy banking and monetary systems. Most digital assets are based on blockchain technology and thus allow for secure, transparent transactions without central oversight, which could lead to cost reduction and increased efficiency.

- Global Market Access

Digital assets have the capability of being transacted across a global scale and reaching financial systems for people in underbanked or unbanked regions. No longer requiring anything other than an internet connection, many now have access to economic activity that would previously have been out of reach, making a huge contribution to financial inclusion.

- Diversification of Investment Portfolios

Digital assets create a new class of opportunities for investing, which allows the investor to diversify their portfolio beyond the stock, bond, and commodity markets. That is why, although most digital assets are so much more volatile and riskier in general, some have indeed turned out to be huge, thus attracting retail and institutional investors over the years.

- Enabling New Business Models

Blockchain and digital assets enable new business models and ecosystems. For example, NFTs have made a lot of difference in the world of art and entertainment, allowing their creators to monetize through ownership rights and royalties for digital content.

- Better Transaction Efficiency and Security

Transactions that take place with digital assets are often quicker and cheaper than traditional financial transactions, especially when crossing international borders. This will guarantee security measures and reduce the chance of fraud with unauthorized transactions, since the blockchain technology is decentralized, making every transaction immutable and encrypted at the same time.

- Improved Control and Privacy

Digital assets come with better control over one’s financial holdings and improvement in the level of privacy. Unlike conventional bank accounts, which are tethered to their owners’ identities and under the custody of a third-party institution, digital asset ownership in most cases vests with the individual and is therefore controlled by the user.

- Regulatory Evolution and Innovation

With increasing preference and trust over digital assets, change is coming in regulatory frameworks across the world. This would mean more pragmatic financial regulations that serve the digital age even better, in fact encouraging more innovation in the sector.

- Smart Contracts and Decentralized Applications

Digital assets often come with programmable conditions known as smart contracts, which are self-executing based on mutual agreements without an intermediary. It opens the gateways for decentralized applications into realms far more critical than just mere transactions; in, for example, decentralized finance (DeFi) and supply chain management.

- Crisis Resilience

Digital assets have been batted about as a kind of hedge against economic uncertainty. In inflation or periods of crisis of traditional financial systems, digital assets such as Bitcoin have been cast as alternative stores of value, although this is highly debatable and extremely dependent on market circumstances.

Digital assets become important because they are able to develop a financial system that is more inclusive, efficient, and innovative; however, they come with new risks and challenges that need careful technological advancements.

Examples of Digital Assets To Trade

Digital assets encompass a broad category of tradable instruments on various platforms. Some of the common examples of digital assets that feature widely in trading are:

- Cryptocurrencies

Bitcoin (BTC) – also called digital gold, Bitcoin is the first and by far most popular cryptocurrency, which is widely used for both investment and transfer of value.

Ethereum (ETH): Smart contract capable; it is a DApp platform.

Ripple (XRP): A currency used mostly to facilitate cross-border payments, enabling financial institutions to transact overseas with very minimal fees and in no time.

Litecoin (LTC): Like Bitcoin, but the confirmation time for transactions is five times quicker than Bitcoin’s, which makes it appropriate for micro-transactions and point-of-sale payments.

Cardano (ADA): Aims to be sustainable and scalable, bringing advanced features developed by using evidence-based methods.

- Stablecoins

Tether (USDT): A stablecoin created to be pegged to the US dollar and to combine the advantages of cryptocurrency with the steadiness of fiat values.

USD Coin (USDC): This is another stablecoin pegged to the U.S dollar and is backed by financial assets in reserve accounts.

Binance USD (BUSD): A stablecoin issued by Binance, in partnership with Paxos, also pegged to the U.S. dollar.

- Utility Tokens

Chainlink (LINK) Utility Tokens: Chainlink is a decentralized oracle network that enables blockchains to securely interact with external data feeds, events, and payment methods.

Filecoin (FIL): A token for decentralized data storage, with miners who provide spare storage to be paid in FIL.

VEChain (VET) – This project deals with supply chain management and bringing transparency to how it can be better and how to eliminate fraud on a global scale in trade practices.

- Security Tokens

These are digital assets that derive their value from an external, tradable asset. Security tokens fall under the federal laws governing securities; they offer investment contracts and represent shares in external assets or companies.

- NFTs, or Non-Fungible Tokens.

NFTs are used to represent ownership of unique items and offer proof of their provenance through blockchain technology. NFTs are applicable in digital arts, collectibles, and other forms of digital goods.

CryptoPunks: One of the earliest NFT projects is a limited collection of uniquely generated characters.

Bored Ape Yacht Club: A series of digital art pieces with variations of cartoon apes. This collection has been extremely popular and valuable.

- DeFi: DeFi stands for Decentralized Finance.

Uniswap (UNI): A token affiliated with one of the largest decentralized trading protocols that facilitate automatic trading of DeFi tokens.

Aave (AAVE) and Compound (COMP): These are two tokens affiliated with decentralized lending platforms that provide participants with the possibility of lending and borrowing cryptocurrencies in a trustless manner.

- Governance Tokens Maker (MKR).

In the MakerDAO system, MKR tokens are used for voting on proposals for changing the protocol, such as modifications to interest rates and implementation of upgrades to the system.

Curve DAO Token (CRV): A token dedicated to the Curve protocol, it gives rights to the holders in governing the protocol and participation in revenue-sharing agreements.

These are just a few examples that illustrate the variety and richness of digital assets to be traded within and surrounding the different strands of the financial-technological ecosystem.

Creating Your Own Digital Asset Trading Platform: Key Considerations

You can create a digital asset trading platform even when the market seems to be saturated. With the right kind of approach, you can strategize for product diversification to attract market interest. Here are critical pointers to help you through the process:

- Competitor Analysis

– Learn from Others: There is always room for innovation, even if the market is quite full. It is important that you make an in-depth analysis of your competitors, so you know what their strengths and weaknesses are. This way, you can decide which features will make it to the MVP and what to develop afterward. Thus, knowing what already exists will let you know where there are potential gaps to fill in the market.

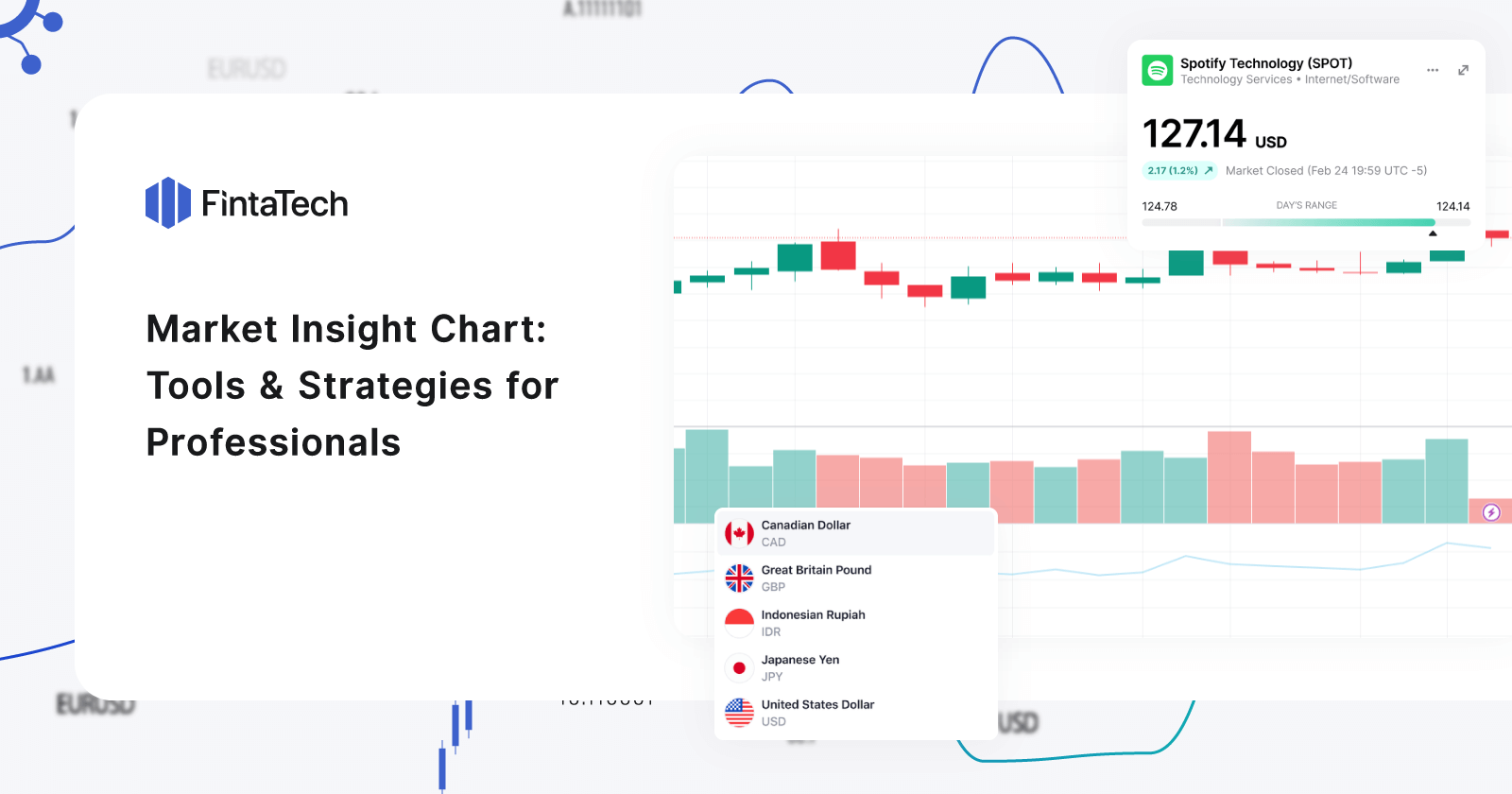

- Leverage Artificial Intelligence

– Supercharge Capabilities with AI: Artificial intelligence is indispensable to today’s trading world, processing humongous volumes of data and making predictive analyses. Integrate AI tools to allow your users greater forecasting powers and customized trading strategies. This will not only make the user experience one-of-a-kind but also enable smarter and faster trading decisions from your end, giving your platform the competitive advantage it needs.

- Automation Features

– Streamline Trading Processes: Automation is an important feature in most modern trading platforms. In these, users can set trading parameters that get to automatically initiate a trade once a particular condition is met. This means the traders can act a little more passively with the confidence that the system is working away even when they’re not watching it. This particularly becomes very important for users who are handling multiple trades or are using complex strategies.

- Mobile Integration

– Prioritize Mobile Access: Design a mobile version for your platform that is seamless in use compared to its desktop version. With the increasing presence of mobile devices, adopt a ‘Mobile First’ approach; begin design with a fully functioning, intuitive mobile appᅳit is often easier to size and scale features up than to scale them down. With this, the instant the mobile version meets all requirements for usability, it is so much easier to scale up those designs for use on bigger desktop displays. This approach will ensure that users can handle their trades on the move with more access and user engagement.

By focusing on these areas, you can create a digital asset trading platform that not only meets the needs of today’s traders but also stands out in a competitive landscape.

Conclusion

Digital asset trading is a striking step in financial life that harnesses the power of blockchain technology to change ideas related to both exchange and traditional investment. Throughout this continuous growth, it has opened numerous possibilities for investors, innovators, and just plain general users—a perfect base for better accessibility, security, and efficiency. It will aid people and institutions in understanding the mechanisms, relevance, and potential of digital assets very much in a dynamic and competitive environment. Looking into the future, the capabilities of these digital trading platforms with the use of such sophisticated technologies, like AI and mobile solutions, will continue to expand, proving that financial innovation is at the heart of it all. But the movement is reshaping the world of finance: it is laying the groundwork for a new, more inclusive and more effective global economic system.

Twitter

Linkedin

Facebook