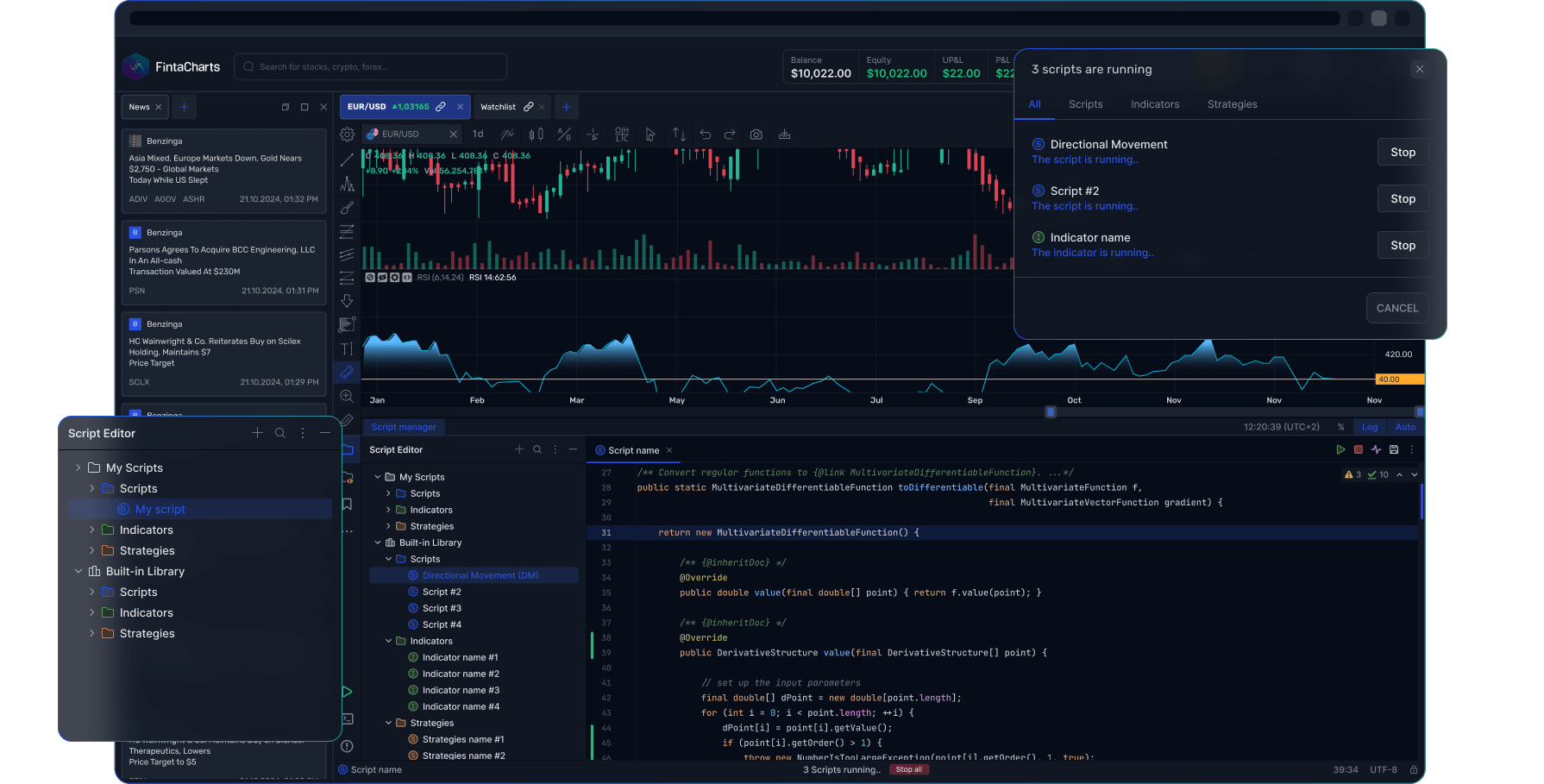

Easy Strategy Building

Simple editor with templates and intuitive C# scripting environment.

FintaScript gives you a simple in‑chart editor with powerful tools: 110+ built‑in indicators, multi‑timeframe data, broker integrations, historical backtests, and flexible alerting.

110+ Indicators

Multi‑Series

C# API

Backtesting

Alerts

Broker & Data Integrations

FintaScript is the scripting engine embedded into Fintacharts that allows traders, quants, and fintech platforms to bring their trading ideas to life

With a powerful C# API, users can:

Write custom strategies, indicators, and alerts.

Run scripts across multiple instruments and timeframes.

Connect seamlessly with market data providers and brokers.

Backtest ideas on historical data, then go live with confidence.

FintaScript serves different types of users across the trading ecosystem with enterprise-grade capabilities

Empower your users to build custom indicators and strategies with a comprehensive scripting solution.

Prototype and launch signals quickly without complex DevOps infrastructure or lengthy development cycles.

Automate trading tasks and implement custom strategies in a familiar charting interface.

Our technology adapts to your unique business model, helping you scale faster, manage smarter, and stand out in a competitive market.

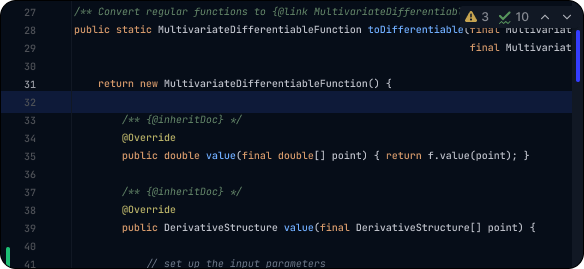

Our intuitive C# editor provides real-time syntax highlighting, autocomplete,

and access to 110+ built-in indicators. Build sophisticated trading strategies

with multi-timeframe analysis and comprehensive market data.

Real-time code editor with IntelliSense

Multi-timeframe chart analysis

Built-in indicator library

Simple editor with templates and intuitive C# scripting environment.

Multi-instrument and multi-timeframe support across different asset classes.

Moving averages, RSI, Bollinger Bands, and comprehensive technical analysis tools.

Market and limit orders with advanced position management capabilities.

Popup, sound, email notifications, and custom alert triggers.

Comprehensive historical backtesting with detailed performance analytics.

Sandbox mode for risk-free testing and secure script sharing capabilities.

Secure and optimized execution cycle with enterprise-grade performance.

From concept to live trading in five simple steps

Write your script in the built‑in C# editor or import from repository.

Configure data sources: instruments, timeframes, and history length.

Connect to broker or market data (via Fintacharts connectors).

Run a backtest → view metrics, logs, and trade actions.

Go live with real‑time alerts or auto‑trading.

Connect with your existing trading infrastructure

Seamlessly integrated with the main trading platform

Visual chart customization and layout tools

Exchanges, Crypto, OTC, and alternative data sources

Direct integration with major brokerage platforms

Popular trading strategies and research applications trusted by professionals worldwide

Capture moving average crossovers or momentum shifts.

Bollinger/Donchian based entries and exits.

Multi‑instrument spreads and statistical arbitrage setups.

Alerts on volatility spikes or account drawdowns.

Prototype factors, test custom indicators.

Explore the latest trends, tips, and insights in your world

A White Label Trading Platform is a harmonized software solution aiming to present businesses with professional grade trading software products under their trademark. Such a setup helps companies launch a platform quickly and reduce costs and technical overhead.

It can be customized according to the logos, colors, and visual identity of your firm in order to make our robust white label trading software an extension of your brand.

Yes, we do provide a trading software demonstration to interested clients and allow them to scrutinize features and evaluate the solution.

We make sure the white-label trading platform is always equipped with the changing technology. It is updated and upgraded without any downtime or hassle.

White label trading platforms are implemented perfectly in the cases of financial institutions, brokerage firms, and fintech startups that are interested in adding trading but are not willing to incur the huge investment required to execute the software from scratch. It's a solution that makes it possible for businesses to go-to-market swiftly with a solid, ready-to-deploy platform.

Twitter

Linkedin

Facebook