The days are long past when a white-label trading platform was a mysterious piece of technology. Access to the trading market has been made very straightforward with custom, white-label software. These solutions enable companies to offer trading services under their names without doing the heavy lifting in building the technology from scratch. This ultimate guide will be helping you understand everything from white-label trading and its benefits to its core features, which you will have to know to deploy it for your business.

What is a White-Label Trading Platform?

The white label trading platform is considered one of the best cost-saving and time-saving models, so it becomes very attractive for companies that would like to start in the trading market involuntarily with huge investments in development with their proprietary technology. This model opens access for business not only to advanced but also time-tested technologies and security measures that at once secure its reliability and performance. Moreover, white-label platforms can allow firms to concentrate on core competencies: customer servicing, market expansion, and branding strategy, instead of intricate software programs. Moreover, it is not just about time-to-market; the scalability ensures that businesses are able to move very quickly by innovating and updating their platform functionalities based on market changes and customer needs. The white-label solution also caters to the needs of ongoing support and maintenance, meaning that a company will have a possibility for continuous enhancement and troubleshooting without the need to keep a large IT team inside the company. In dynamic and changing financial markets, this ensures sustenance and the smooth conduct of trading operations.

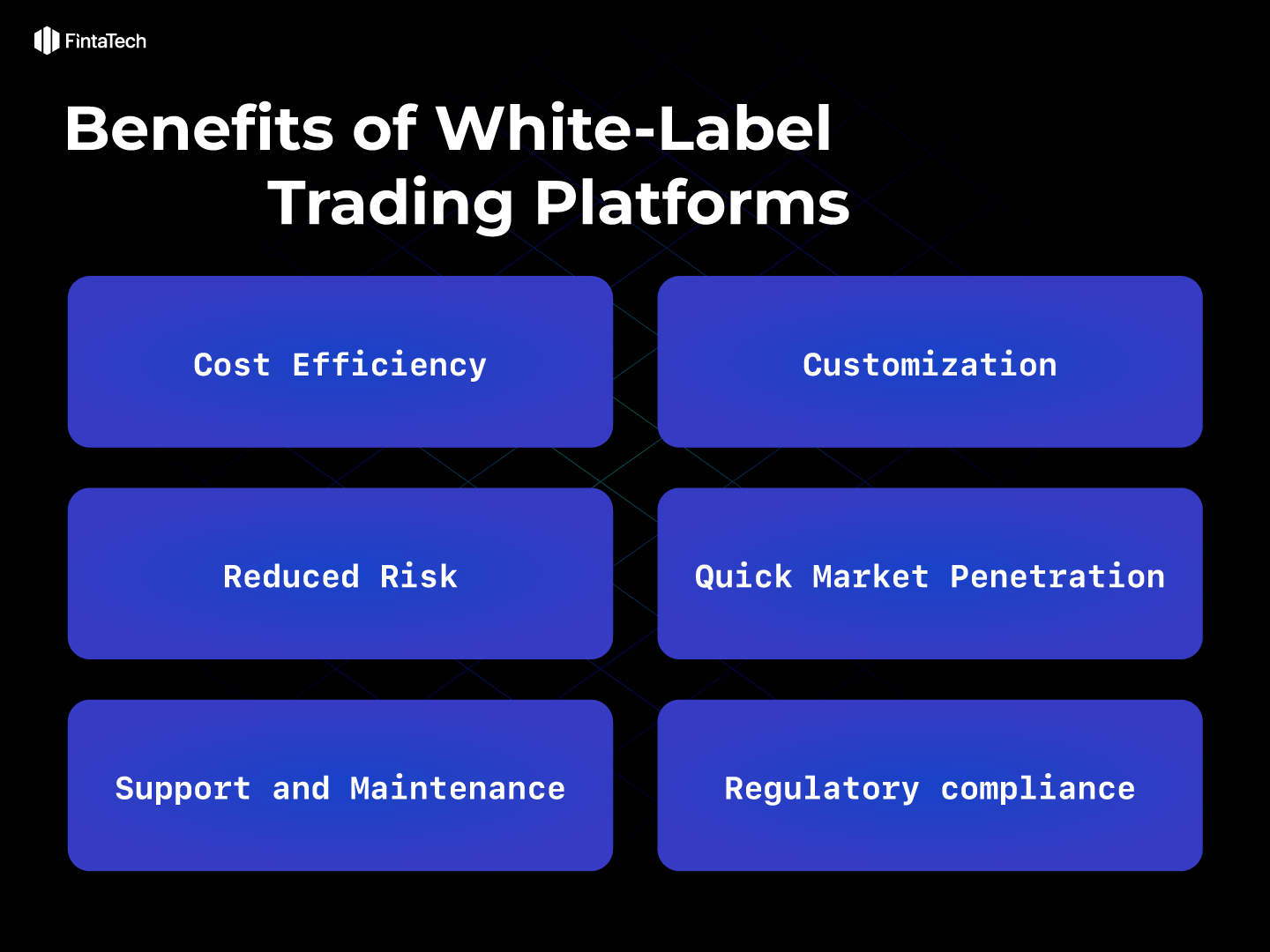

Benefits of White-Label Trading Platforms

So, white-label trading platforms can offer a plethora of lucrative opportunities—enough to attract any business to get into the financial market or to expand its offerings. Here is some detail on the benefits:

- Cost Efficiency: In fact, developing a trading platform from scratch becomes a very costly thing since it requires much research and development, laborious testing, and regulatory compliance. White label solutions are fully functional platforms in which businesses can realize savings for the development and infrastructure costs at a fraction of the cost.

- Quick Market Penetration: White-label platforms are readymade solutions that may be rebranded and, to a significant extent, customized, hence enabling businesses to launch their services much faster as opposed to developing the same within the organization. This rapid deployment helps firms capitalize more quickly on market opportunities.

- Reduced Risk: Instead of the companies being pioneers in the software-development area, they are subjected to a reduced risk factor because of using a proved platform in the market. The risk involved in not insuring software development failure or rather other unforeseen technical issues is also covered. This also includes undergoing updating and maintaining it, thus lowering the technical risk.

- Advanced technology: Most of the advanced technologies and features that come with white-label platform providers are far from what firms could develop themselves or have the resources to do. The advanced charting tools, order management systems, and algorithmic trading features are examples.

- Regulatory compliance: Regulatory compliance in finance is involved and an ongoing process. White-label platforms usually make a point to include in-built compliance features, which update as the regulations change, taking the burden off client firms to have to consistently monitor and implement changes in regulations. Core features remain more or less standard on white-label platforms, but a user can always customize them to ensure differentiation within the turnkey business solution. They are also built for scaling, accommodating growth in the number of users and volume of transactions with little additional investment.

- Support and Maintenance: Continuous support and maintenance is part of the service being rendered, whereby in return, it will assure one smooth operation of the platform as it updates with the latest technological developments and security measures. Moreover, the support is very helpful against all technical questions and thus ensures minimum downtime for not losing clients’ satisfaction.

- Brand Building: Businesses can brand the platform as their own thanks to white-labeled solutions, which helps them build loyalty with and trust among their users. That can be a very critical factor within the really competitive financial services industry.

Managing a white-label platform helps a business focus on its main competencies: service to the client, marketing, and product development. All other heavy work of this technical nature is geared by the platform provider, hence overall saving time and money. This adds to the firm’s operational efficiency necessary to remain competitive within the fast financial markets.

How to Select the Right White-Label Trading Platform Provider

Designing the white-label trading platform provider of your choice is perhaps one of the most significant activities a financial institution has to undertake in order to deliver trading services without developing proprietary technology. Consider the following criteria for choosing:

Technology and Infrastructure: Go for leading-edge, reliable technology that can support increased transaction volumes and whose capability is scalable. Check its uptime record and the quality of the data center.

Customization and Branding: Ensure that the platform is deeply customizable to resonate with your brand image. Also, check the degree of control you can still maintain over the user interface and experience.

Product Range: Select providers who offer an extensive portfolio of financial products such as equities, foreign exchange, commodities, and cryptocurrencies. Check how easily and flexibly new products can be added to meet a new market demand.

Regulatory Compliance: The provider should be able to act in line with the customary financial regulations of the specific regions where your business operates. Look for in-built risk management and compliance tools.

Support and Training: Check how good customer and technical support is and whether sufficient training will be accessible to your team.

Cost Structure: Determine the total cost structure, which includes potential setup fees, monthly charges, and charges for additional services. Assure that the pricing model is aligned with business goals.

Integration Capabilities: It should easily integrate with other systems, such as CRM and the analytics tools already at work. Check the availability of APIs and other technical features that facilitate integration.

Security Features: Prefer the platforms with solid security measures, for example, two-factor authentication, encryption, regular audits, among others.

By carefully assessing these factors, you can select a white-label trading platform provider that meets your business needs and enhances your ability to effectively serve your clients.

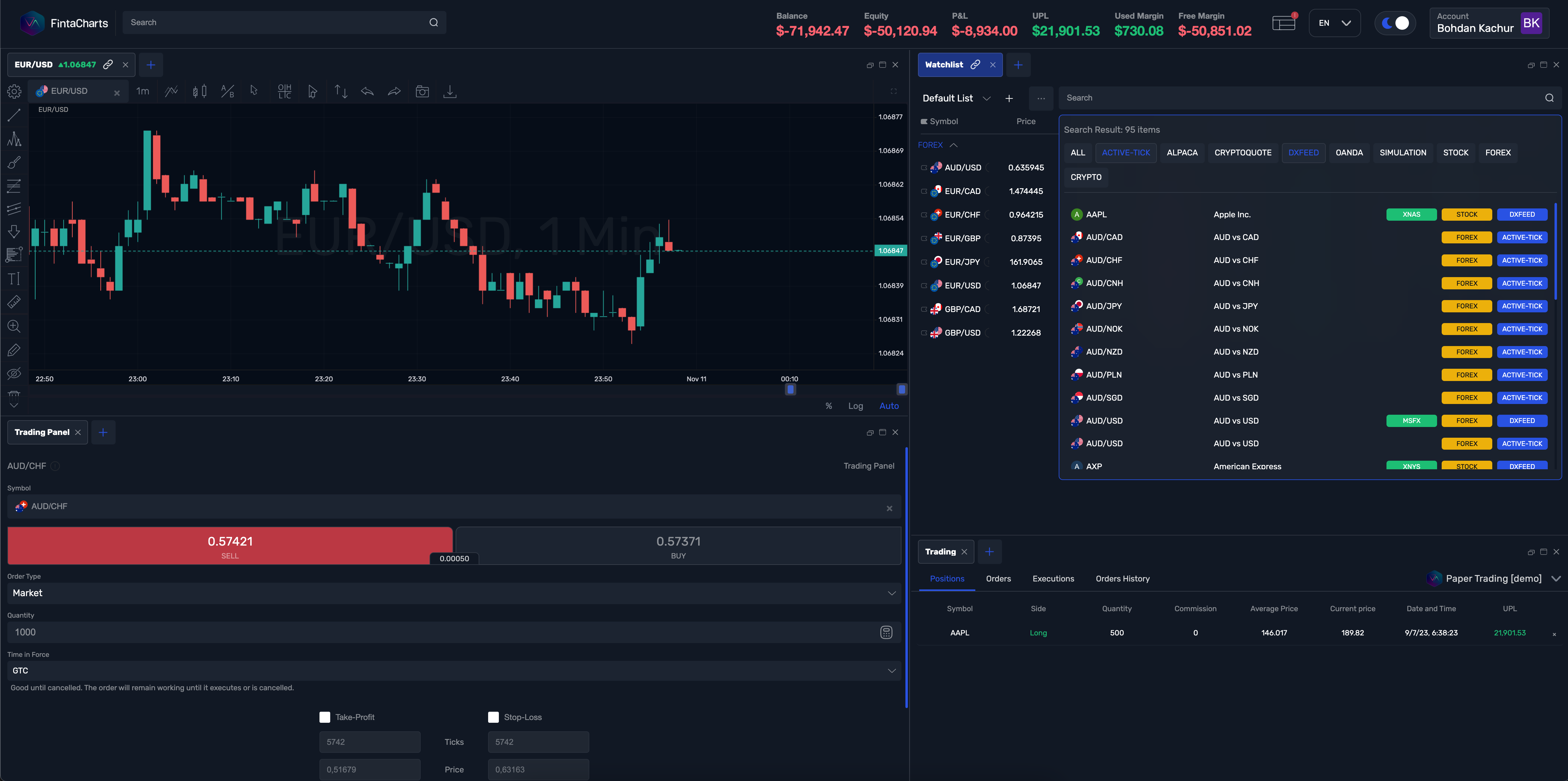

White Label Trading Platform from FintaTech

FintaTech’s white-label trading platform is distinguished by its advanced technology and extensive customization options, designed to deliver a superior trading experience tailored to individual styles and business needs. Leverage maximum layout customizations in helping you lay out your charts, news feeds, and critical data within the workspace to suit your unique preferences. It is also fully packed with various tools that range from Market Data, Charts, Indicators, real-time data, Alerts, Strategies, Orders, and Positions, with the further ability of the white-labeled trading app extended to mobile devices.

Some of the key benefits of using FintaTech are:

Time to Market: Companies can bring their trading platforms very quickly to the market through FintaTech’s efficient deployment process of the platforms, thereby significantly reducing time consumption for capitalizing on the opportunities before others.

Featuring robust security and high performance, the platform is engineered for effective data and trading operations supported by advanced encryption and around-the-clock security monitoring to protect client transactions and data.

Flexibility in Contract Options: At FintaTech, we do understand that each financial firm comes with different needs; therefore, the contracting by the financial firm can be varied in terms of scale and other specific requirements of the client to provide flexibility in terms of partnership.

Support and Maintenance: With maintenance, a responsive technical support team, and available additional features, the platform is kept in check in case issues occur, ensuring high uptime and reliability. Updating with new features enhances the best user experience. Know how FintaTech will help you regain your trading finesse and find your space back in the market. Request a free demo right now to discover fully what you can expect from the platform. These are features that would make FintaTech white-labeling trading solutions perfect for any financial institution that is looking to offer tailor-made, productive, and secure trading services to their customers.

Conclusion

White-label trading platforms are good investments for businesses planning to get into business or expand their business in the trading market. With such a solution, companies can save plenty of development costs, accelerate time to market, and implement an absolutely secure, high-performing, branded trading experience. In embracing this initiative, make sure you partner with a vendor who shares your business vision and will be able to deliver a truly scalable, secure, and compliant exchange platform.

Interested in white label trading platform solutions for your business? Contact us and get a consultation now about how our solutions can be tailor-made to suit your needs in order to reach business goals.

Twitter

Linkedin

Facebook