Launching a trading platform is no small feat. In a market defined by speed, innovation, and ever-evolving regulation, the technology you choose can either accelerate your growth, or hold you back. For brokerages, fintech startups, and financial institutions alike, the question is no longer if you need a robust digital trading solution, but how to build or acquire it. This is where the decision between a White Label trading platform and a Custom-built solution becomes critical.

White Label platforms promise speed, lower upfront costs, and a proven foundation is perfect for fast market entry. Custom solutions, on the other hand, offer unmatched flexibility, control, and scalability — ideal for those playing the long game or pursuing a unique value proposition.

In this article, we’ll explore the pros and cons of each option, unpack the technical and business implications, and help you determine the best route based on your goals, budget, and timeline.

What is a White Label Trading Platform?

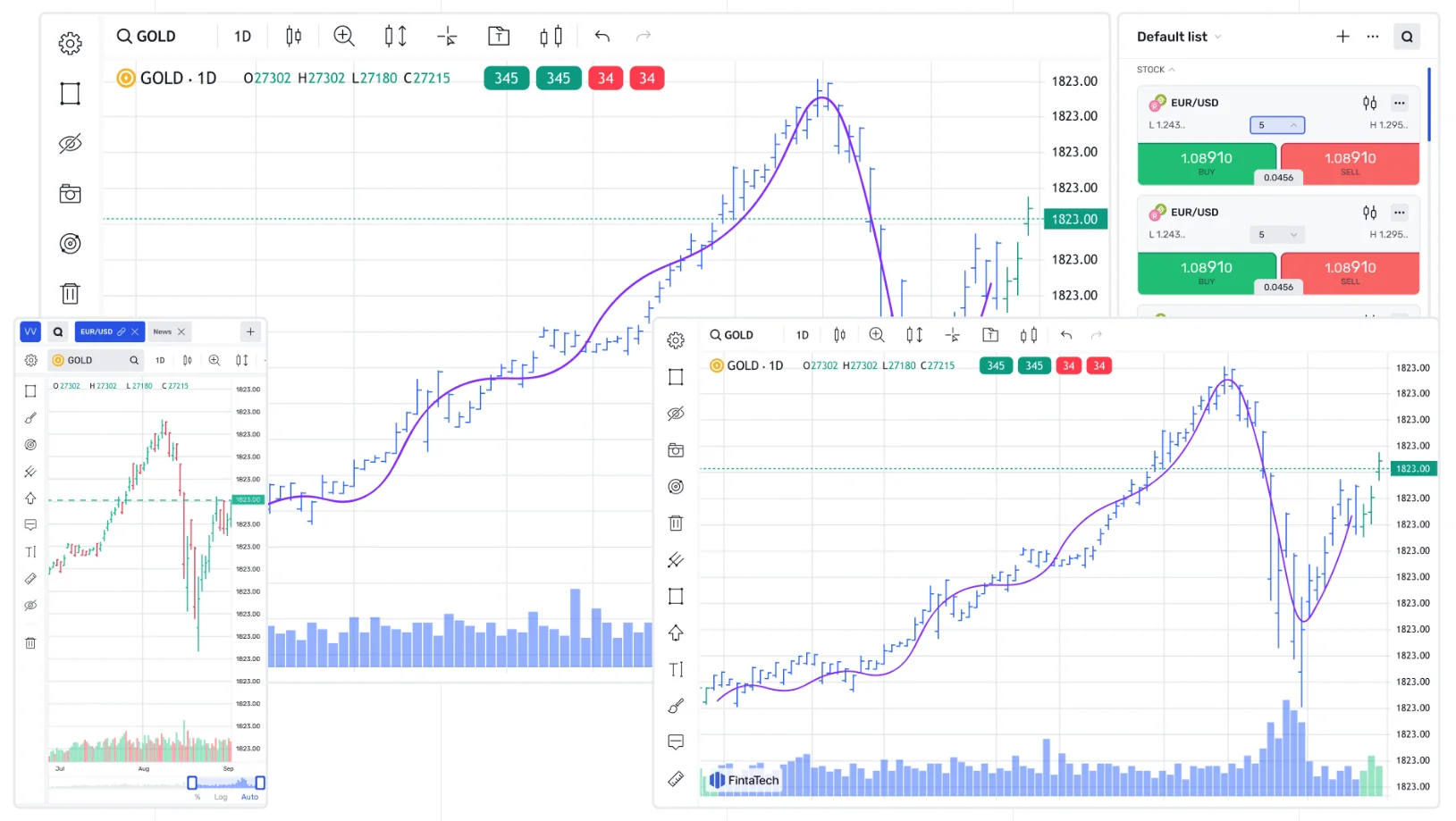

A White Label trading platform is a pre-built software solution provided by a third-party vendor, which allows brokerages to launch their own branded trading services without developing the platform from the ground up. These platforms are designed to be fully functional out of the box and typically include essential components such as trading terminals, client portals, charting and analysis tools, risk management systems, back-office functionality, and regulatory compliance features.

The core idea behind a White Label solution is simple. Instead of investing time and resources into building a trading system internally, a brokerage can license an existing platform and customize it with its own brand identity. This usually includes elements like the company name, logo, color scheme, domain, and user interface language. The underlying technology remains managed and maintained by the original vendor, which means that the brokerage benefits from a stable infrastructure, regular updates, technical support, and security monitoring without taking on the full development burden.

White Label platforms are especially popular among new brokerages, fintech startups, and firms entering new markets. These solutions provide a fast and cost-effective way to offer professional-grade trading services while focusing on business development, marketing, and client acquisition. In many cases, a White Label partner also assists with regulatory setup, hosting, liquidity integration, and customer onboarding processes.

However, this approach comes with trade-offs. Since the software is not developed in-house, the level of customization is often limited to what the vendor allows. Brokerages may not be able to modify key system features or introduce unique functionalities unless the provider offers modular add-ons or API access. Additionally, long-term dependence on a third-party vendor may limit strategic flexibility as the business grows or seeks to differentiate itself from competitors.

Despite these limitations, White Label trading platforms remain a powerful option for brokers that prioritize speed, efficiency, and lower initial investment. They offer a proven path to market entry while reducing the risks typically associated with custom software development.

What is a Custom Trading Platform?

A Custom Trading Platform is a fully tailored software solution built specifically to meet the unique needs, goals, and workflows of a particular brokerage or financial institution. Unlike white label platforms, which are pre-built and shared across multiple clients, a custom platform is developed either entirely from scratch or by deeply modifying an existing framework to reflect the organization’s exact specifications.

The development process typically begins with a detailed discovery phase, where business objectives, user personas, regulatory requirements, and market positioning are clearly defined. From there, a dedicated team of developers, designers, and financial technologists builds the platform’s front-end and back-end systems, ensuring that everything—from the trading interface and order execution logic to reporting tools and integrations—is designed around the brokerage’s strategic vision.

Custom platforms offer a level of flexibility and control that white label solutions cannot match. Every component can be optimized for a specific audience, whether retail traders, professional investors, or institutional clients. Features such as proprietary trading strategies, algorithmic execution tools, bespoke user interfaces, custom reporting dashboards, and advanced risk management engines can all be built into the system. Moreover, firms retain full ownership of the intellectual property, allowing for ongoing innovation without vendor constraints. This approach is ideal for brokerages with unique operational models, complex product offerings, or long-term plans to scale and differentiate in a crowded market. It also supports seamless integration with in-house tools, third-party APIs, and specialized data feeds that may not be available through off-the-shelf platforms. However, building a custom trading platform requires a significant investment of time, money, and technical resources. Development timelines can range from several months to over a year, depending on the complexity of the platform. The responsibility for security, compliance, maintenance, and scalability also rests entirely with the organization or its chosen development partner.

Despite the higher cost and effort involved, a custom trading platform offers unmatched strategic value. It empowers brokerages to create a unique digital experience, respond faster to market changes, and build a long-term competitive advantage through innovation and full technology ownership.

White Label vs Custom Trading Platform: Key Comparison

When deciding how to launch or scale a trading business, one of the most critical strategic choices is whether to adopt a white label solution or invest in a custom trading platform. Each option carries distinct advantages and trade-offs that affect your time to market, operational flexibility, cost structure, and long-term competitiveness.

White label platforms are designed for speed and simplicity. They allow brokerages to enter the market quickly with minimal development effort, leveraging proven technology managed by an external provider. Custom platforms, by contrast, are built to give firms full control over features, branding, and system architecture — but they require more time, resources, and technical ownership.

The comparison below breaks down the key differences between the two approaches:

| Feature | White Label Platform | Custom Platform |

| Time to Launch | Few weeks | 6 to 12+ months |

| Cost | Lower upfront investment | High initial development cost |

| Branding | Limited or vendor-controlled customization | Fully owned and uniquely designed brand experience |

| Regulatory Readiness | Often includes pre-integrated compliance tools | Requires custom integration and setup |

| Control over Features | Limited to vendor’s roadmap and modular options | Full control over features, logic, and integrations |

| Maintenance | Managed by the platform provider | Managed in-house or by a dedicated development partner |

This overview helps clarify how each model aligns with different business priorities. If your brokerage values rapid deployment and reduced complexity, a white label platform may be the best starting point. If your focus is long-term innovation and differentiation, a custom solution offers the flexibility and ownership needed to stand out in a competitive market.

When to Choose a White Label Trading Platform

A white label trading platform is often the ideal choice for brokerages that prioritize speed, simplicity, and a lower barrier to entry. It offers a fast and cost-efficient way to establish a presence in the market without taking on the complexity of building and maintaining a custom system.

You should consider a white label solution if:

- You want to launch quickly. White label platforms are pre-built and can often be deployed within a few weeks. This makes them a smart choice for brokerages that want to seize market opportunities or test new regions without delay.

- You have a limited development budget. Building a trading platform from scratch requires significant investment. White label solutions offer enterprise-grade functionality at a fraction of the cost, making them attractive for startups and lean operations.

- You don’t have in-house tech expertise. A white label vendor handles all technical infrastructure, from hosting and security to updates and maintenance. This allows your team to focus on sales, marketing, and client relationships.

- Your use case is standard. If your brokerage does not require highly specialized features or unique trading logic, a white label platform can cover most, if not all, of your functional needs.

- You want built-in regulatory support. Many white label platforms come with integrated compliance tools such as KYC, AML, and reporting systems, which can help streamline licensing and onboarding in regulated markets.

While a white label platform may not offer the same level of customization or ownership as a custom solution, it significantly reduces time-to-market and operational complexity. For many brokers, especially those in the early stages of growth or market testing, it provides a strong foundation with minimal risk.

When to Choose a Custom Trading Platform

A custom trading platform is the right choice for brokerages that aim to deliver a unique user experience, scale their operations, or gain long-term control over their technology. Although it involves a greater investment of time, money, and internal resources, this approach offers unmatched flexibility and the ability to innovate without limitations.

You should consider developing a custom platform if:

- Your business has specific or complex requirements. Standard solutions may not support your trading logic, asset types, or operational processes. A custom platform allows you to build exactly what your business needs, from the ground up.

- You want to deliver a distinctive and branded user experience. If your goal is to stand out in a crowded market and offer a fully customized interface with unique features, a custom solution gives you complete creative control.

- You are targeting experienced traders or institutional clients. These segments often demand advanced capabilities such as custom reporting, deep analytics, API integrations, or algorithmic trading tools that are not always available in white label platforms.

- You plan to grow and expand significantly. If your roadmap includes launching in multiple regions, adding new asset classes, or supporting high trading volumes, a custom-built system can scale in line with your long-term strategy.

- You want full ownership of your platform. With a custom solution, your business owns the software, the user experience, and the data. You are not tied to a vendor’s limitations or update cycles, which allows for greater independence and control.

Building a custom trading platform is a strategic decision that requires technical leadership and a long-term vision. However, for brokerages focused on innovation, flexibility, and brand differentiation, it provides the foundation to grow with confidence and compete at the highest level.

Hybrid Strategy: Tailoring Growth to Fit Your Brokerage

For many brokerages, the decision between a white label and a custom trading platform does not have to be all or nothing. A hybrid approach can offer a flexible middle ground, allowing firms to combine the speed of a white label launch with the long-term advantages of custom development.

One common strategy is to begin with a white label platform in order to enter the market quickly, validate the business model, and generate early revenue. This allows the brokerage to establish a client base and gather valuable user feedback without taking on the full development burden from day one. As the business grows, the firm can gradually transition to a more customized environment. Some white label providers offer modular APIs or front-end flexibility, which allows brokers to build proprietary features on top of an existing infrastructure. In other cases, a company may decide to replace the white label solution entirely with a custom platform once it has the resources and clarity to define its long-term technology roadmap.

Another hybrid approach involves retaining certain vendor-managed components, such as order routing or compliance tools, while developing a custom user interface or unique trading logic. This can reduce development time while still offering differentiation and control where it matters most. Choosing a hybrid path can be especially valuable for companies that want to balance risk, cost, and speed without sacrificing their ability to innovate in the future. It allows for an adaptive rollout strategy and can serve as a stepping stone from a ready-made product to a fully owned trading ecosystem.

Conclusion: The Right Platform Strategy Starts with the Right Partner

There is no one-size-fits-all solution when it comes to trading platforms. A white label model offers the fastest path to market with lower initial investment and proven infrastructure. A custom platform unlocks full control, deeper integration, and the ability to shape every aspect of your trading experience. And for many brokerages, the most effective strategy lies somewhere in between, a hybrid approach that evolves with your business. Whichever direction you choose, the success of your platform depends not only on the technology, but on the partner behind it.

At Fintatech, we bring years of experience in building robust, scalable trading solutions for brokerages of all sizes. Whether you’re looking to launch with confidence or scale with precision, we’re here to help you align your platform strategy with your business goals. Let’s build something that fits your vision.Explore Fintatech’s solutions or contact us today to discuss the best path forward for your brokerage.

Twitter

Linkedin

Facebook