The fintech and brokerage industries are built on speed, precision, and trust. Every second matters: clients expect smooth onboarding, quick responses, transparency regarding activity on their accounts, and absolute clarity in compliance and reporting. Yet many firms still operate using spreadsheets, scattered email threads, and manual data entry. As a result, valuable leads go unnoticed, and client information becomes fragmented across several tools. This approach worked ten years ago. But today, it slows growth.

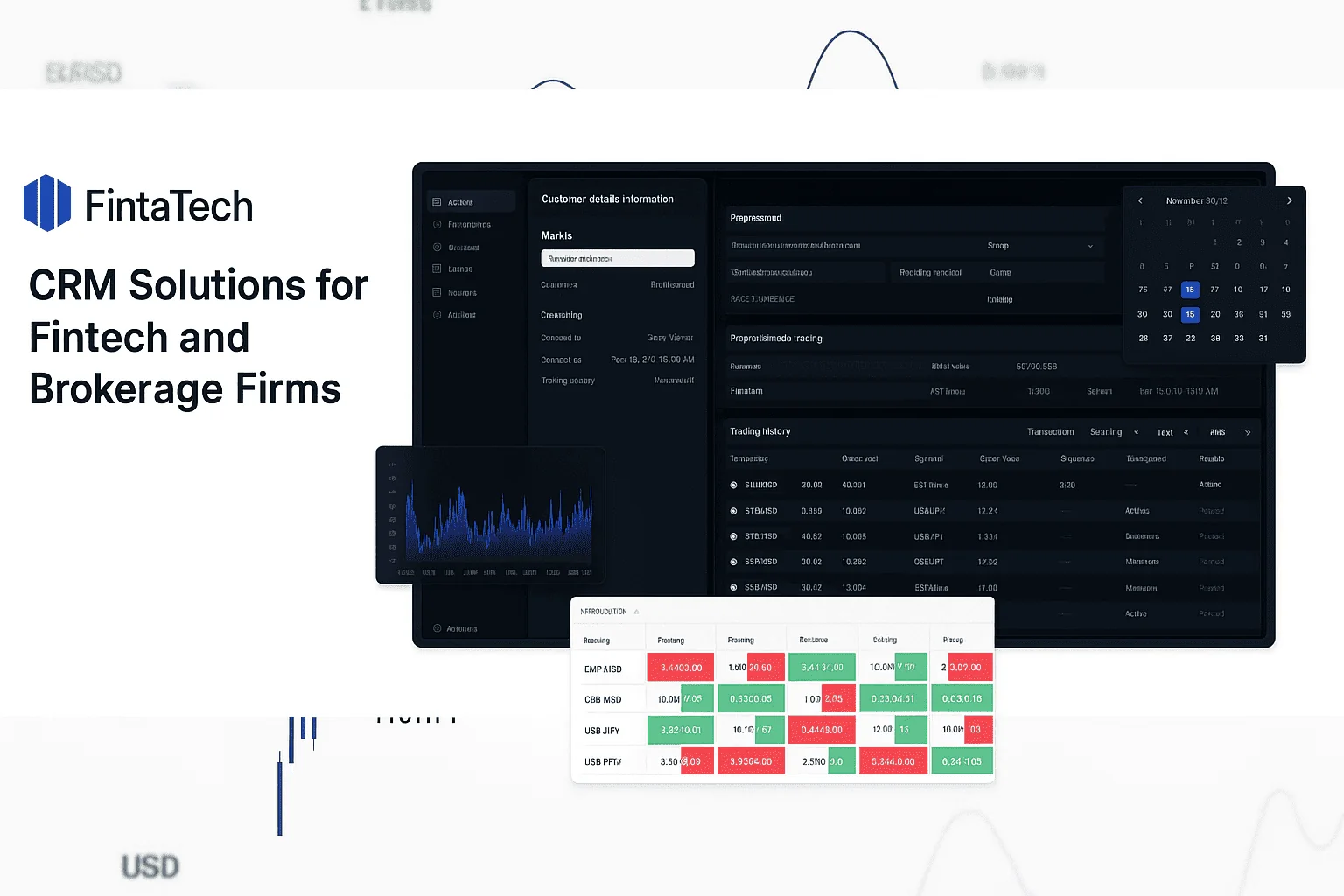

Fintech and brokerage companies handle more than just lead management. They also deal with KYC/AML documentation, multiple account structures, regulatory oversight, analytics, and investor activity. Traditional CRMs are not built for this level of complexity — they require expensive customization and still don’t fully support financial workflows.That gap is what inspired the creation of Finta CRM — a platform built specifically for fintech and brokerage operations.

The Problem: Traditional CRMs Don’t Understand Financial Workflows

A generic CRM can track contact details and a sales pipeline. But fintech and brokerage teams face different challenges:

- A client may have multiple accounts with different investment profiles and risk levels.

- Onboarding must include KYC/AML verification and documentation tracking.

- Client managers need to see trading activity and account performance to understand engagement and potential upsell opportunities.

Trying to force a traditional CRM to manage this leads to complications: excessive manual work, duplicated data, and slow onboarding. Most systems require additional integrations or paid custom development — and still don’t reflect how brokerage operations actually function.

Fintech doesn’t need more tools.

It needs one system that connects lead management, onboarding, account activity, analytics, and communication.

The Solution: A CRM Designed for Fintech and Brokerage Firms

Finta CRM by Fintatech was created to support the full lifecycle of a fintech or brokerage client – from the moment they submit a request to the platform to the moment they become an active trader or investor.

Instead of using separate systems for lead capture, onboarding, account management, and reporting, Finta CRM centralizes everything in one environment.

With Finta CRM, firms can:

- Capture and nurture leads from marketing funnels.

- Automate compliance and onboarding (including document verification).

- Track multiple accounts linked to one client profile.

- Monitor trading activity through integration with trading platforms.

- Analyze revenue, conversion rates, and broker performance.

This enables a seamless experience both for the internal team and the end client — dramatically shortening the journey from first contact → funded account → active trading/investment.

What Makes Finta CRM Different

A key advantage of Finta CRM is its native understanding of brokerage structures. The CRM recognizes that one client can have multiple accounts — for example, different portfolios or different asset classes. The system automatically links all of them under one profile, making interaction clear and efficient.

Onboarding is also automated. Instead of sending documents through email and manually checking their status, managers can:

- Send a secure onboarding link.

- Track document submission and verification.

- Approve or decline with one click.

This reduces onboarding time from days to hours, and helps prevent client drop-off — a common issue in financial onboarding.

Thanks to real-time integration with FintaTrader (or third-party platforms via API), account managers gain immediate visibility into trading activity. They can quickly identify high-value clients, spot inactive accounts, and initiate timely outreach.

How Automation Drives Growth

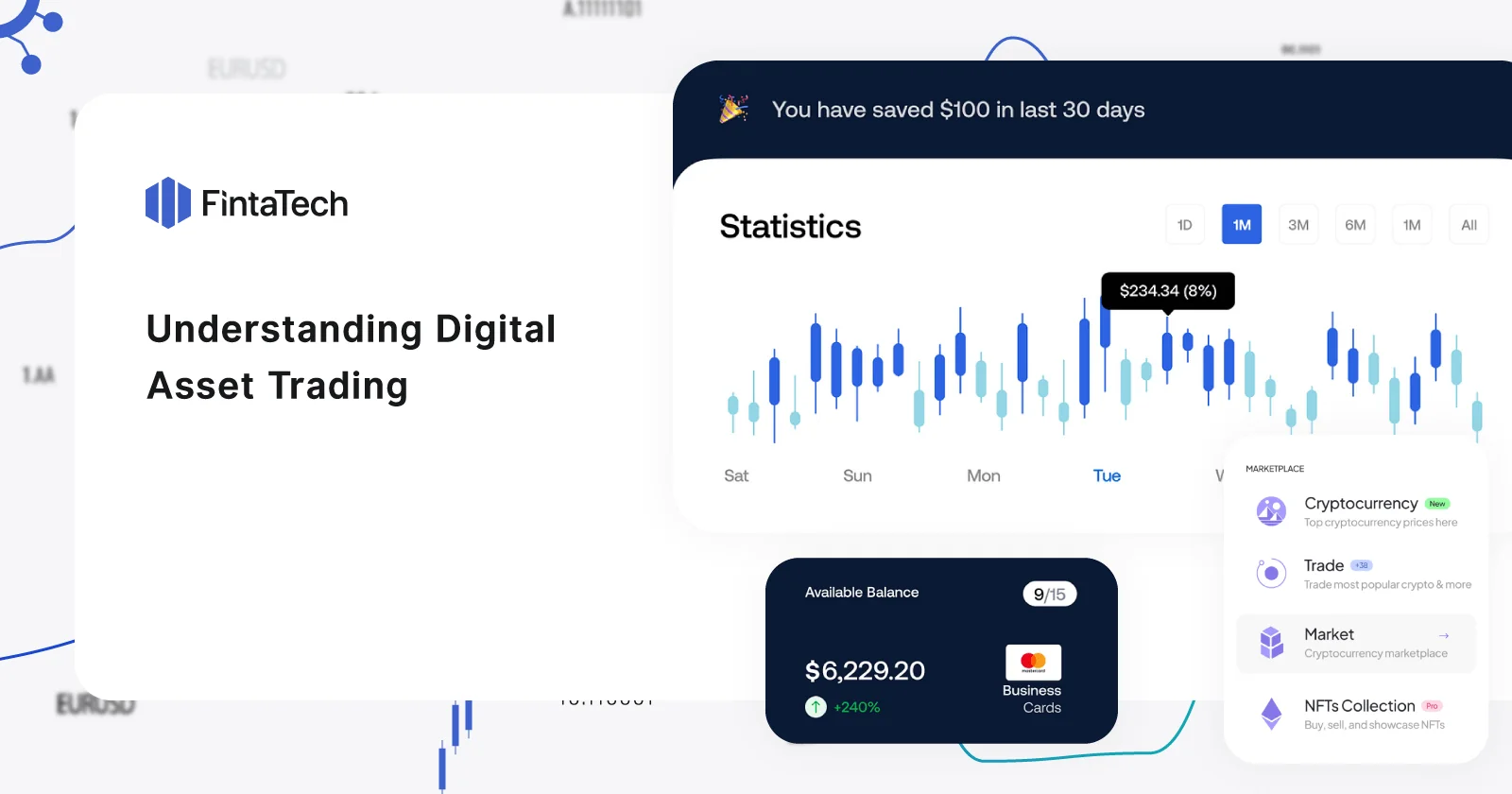

Automation in fintech and brokerage operations isn’t just about reducing manual workload — it directly affects revenue, client engagement, and conversion rates. When workflows are structured and follow-ups happen automatically, no lead is forgotten or lost in the process. Marketing teams gain visibility into lead sources — whether from paid ads, website forms, or partner referrals — and can focus on channels with the highest ROI. Sales managers receive automatic reminders and tasks based on client activity and their stage in the pipeline, helping them convert leads into active funded accounts faster.

At the same time, leadership gains access to comprehensive financial analytics and interactive dashboards that display:

– conversion rates from lead to funded account,

– client activity and engagement,

– revenue distribution by broker or by marketing channel. This turns daily operations into a predictable, scalable growth engine powered by real data instead of assumptions.

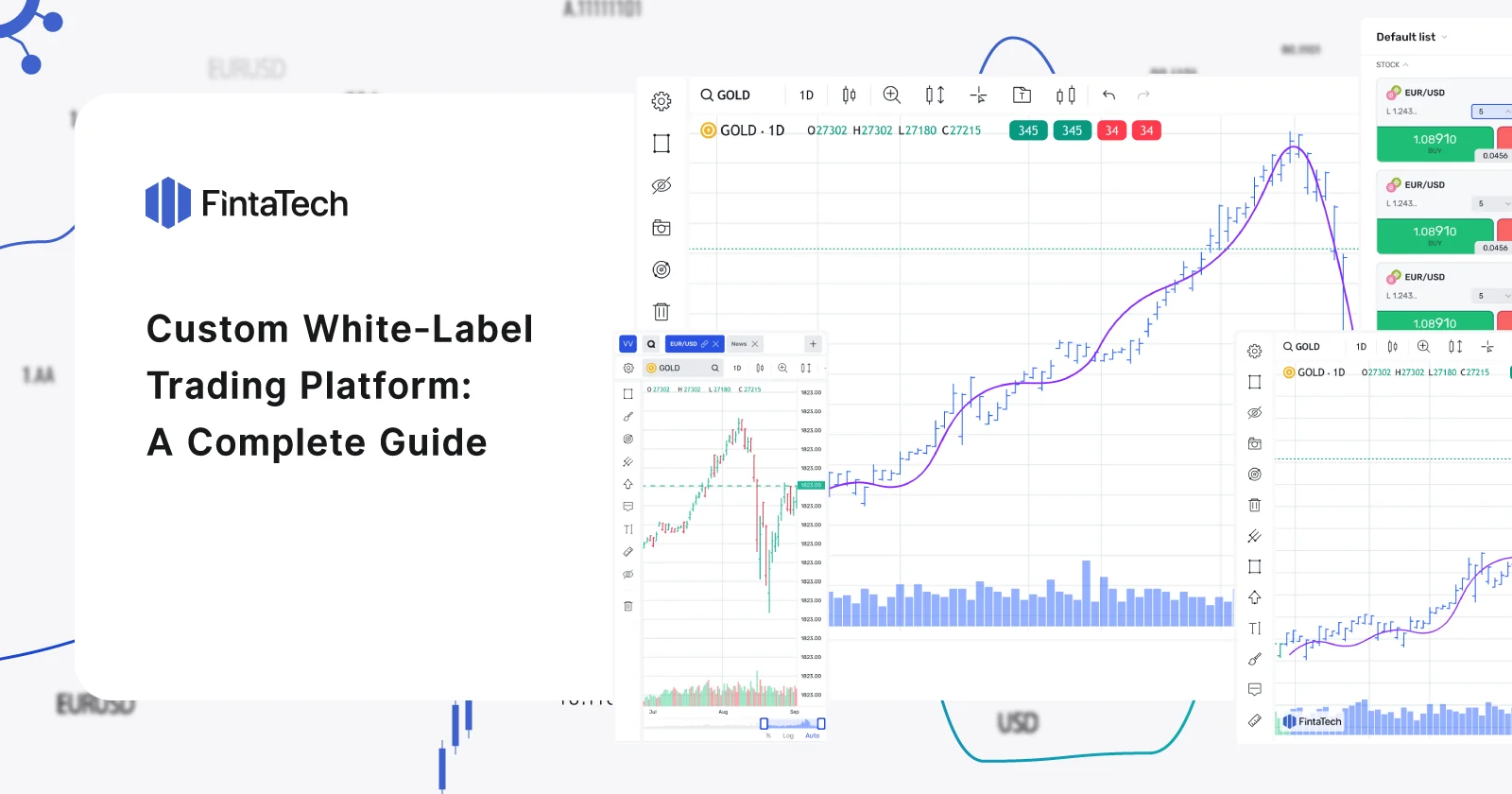

Finta CRM can be implemented in as little as two weeks, with UI customization available to match the firm’s branding. The platform offers a flexible API and seamlessly integrates with operational infrastructure, including:

- trading platforms

- payment systems,

- external databases and back-office tools.

Whether a firm manages 100 or 10,000 clients, the CRM adapts to its structure and processes — allowing the business to scale without increasing operational overhead.

Conclusion

Fintech and brokerage firms do not just manage relationships — they manage money, risk, documentation, and regulatory compliance. A traditional CRM cannot support that level of complexity.

A specialized CRM like Finta CRM transforms operations:

- Faster onboarding → more funded accounts

- Automation → fewer manual errors

- Real-time visibility → better decision-making

Instead of juggling multiple tools, teams can focus on what matters: building relationships and accelerating growth.

➡️ Learn more and book a demo

Twitter

Linkedin

Facebook