Running a Forex brokerage provides excellent opportunities and formidable challenges in 2024 in the changing financial market environment. Technological advancement, as well as regulatory adaptation at all levels, requires comprehension of the basics of running a Forex brokerage: from the types of brokers to necessary technical infrastructure, as without this understanding, entering into such a promising business would not be feasible. Below, we provide an in-depth overview of the various brokerage models, the core technical components of a successful brokerage, and a step-by-step guide on establishing your very own Forex brokerage.

Basic Types and Models of Forex Brokerage Firms

The FX brokerage industry has similarly evolved with the advances in technologies and influence of related sectors where the products and services of these businesses are utilized. Such evolution gave birth to several types of FX brokerage models, such as:

- Electronic Communication Network (ECN) Brokers

An ECN broker is a middleman between the client and other market participants. They bring together buy and sell orders of many market participants and offer these prices to their clients. Most ECN brokers charge a commission on the trade for their services but provide a more open and competitive trading environment.

- Straight Through Processing (STP) Brokers

STP brokers, or no dealing desk (NDD) brokers, deliver client orders directly to the broker’s liquidity provider, such as a bank or another broker, without interference. They are only acting as intermediaries who are neutral in the trade. Mostly, what is talked about under the rubric “STP brokers” are faster trades execution and perhaps narrower spreads.

- Hybrid Brokers

These brokers are a combination of market-making and STP/ECN models. They can sometimes operate a dealing desk for some trades and clients, and at other times, they give direct access to the market. The hybrid model helps brokers to service risks and offers diversified services depending on the difference in needs.

- White Label Forex Brokers

White-label brokers are simply brand names that an established broker gives to its trading infrastructure and technology. They mainly revolve around rebranding services from the parent broker, marketing, and client acquisition. This model provides immediate market entry to businesses or individuals who do not want the hassle of developing their trading infrastructure.

- Introducing Brokers (IBs)

An introducing broker is an agent who refers clients to a primary forex broker in exchange for a commission or rebate. They are often intermediaries between the client and the broker, offering extra services like education or support. The introducing brokers themselves do not handle trades, but they receive commissions based on trading activity by referred clients.

- Market Makers

It simply means the market makers, also known as dealing desk brokers, are the counterparties for the client’s orders. The market makers create their market by offering the buy and sell quotes for these currency pairs. In this way, a broker can be a counterparty to the trade of its client, make a profit from the spread, and hedge to offset the risk exposure.

Each of these brokerage models appeals to different trader needs and preferences, which will shape the dynamics of the Forex trading landscape.

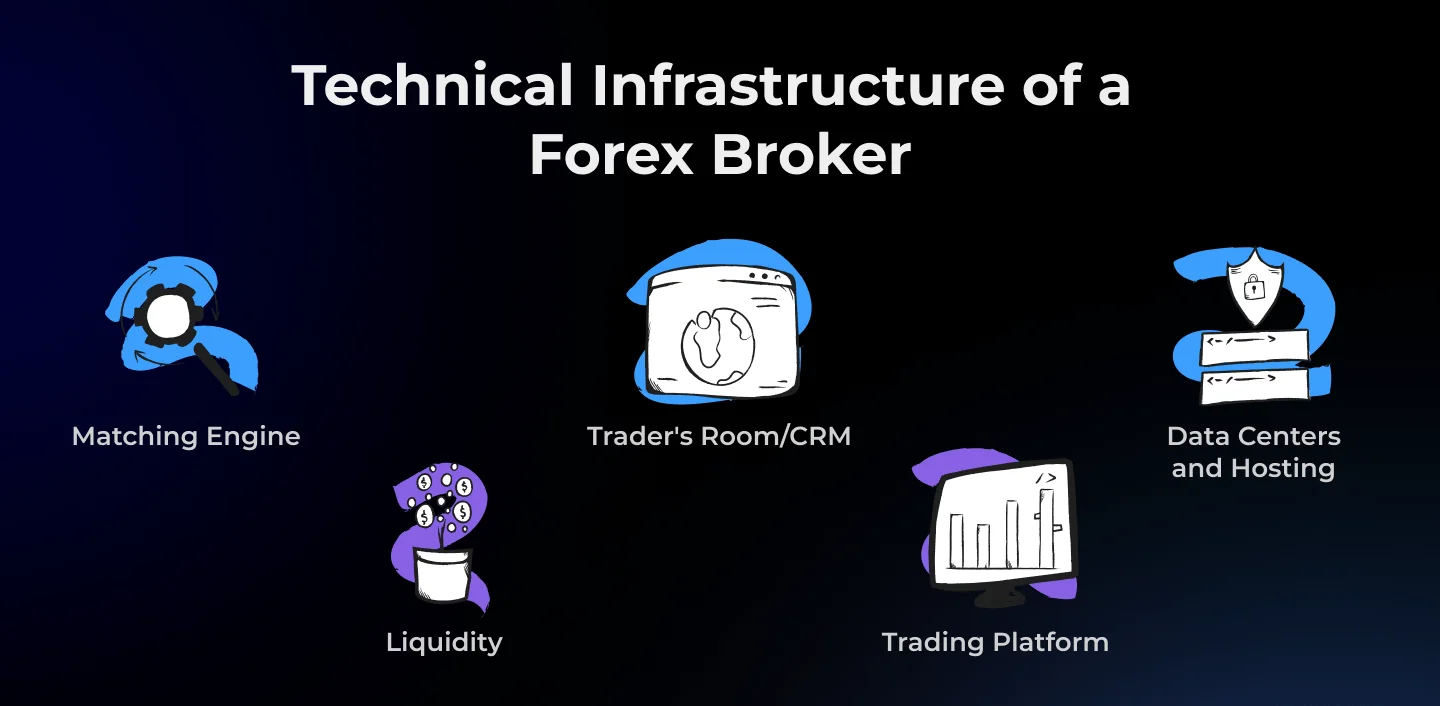

Technical Infrastructure of a Forex Broker

But before doing so, one needs to realize the fact that the exchange is an interconnected system comprising a host of other components, both online and offline, which come together to provide the traders with all the tools required for an integrated and smooth uninterrupted experience. Here are some critical elements of a Forex exchange’s infrastructure that are indispensable for its operation:

- Matching Engine:

At the heart of electronic trading, there is a matching engine: the most sophisticated form of system that matches buy and sell orders in a financial marketplace. It performs quite similarly to a central order book for each trading pair, making sure that its members execute their transactions as quickly and as smoothly as possible at the best available prices.

- Liquidity:

Given that the Forex market has trillions of dollars in daily trading volumes, liquidity is not a problem. Trading occurs in so many different currencies with so many different parties that each transaction needs someone else to trade the other side, hence the importance of major financial institutions acting as liquidity providers. These are the providers, both Forex and commercial banks, that consolidate the funds across different currencies to meet the demand at any time. To what extent these providers offer liquidity does have a significant effect on the spread and market volatility, which in turn affects the trading conditions for each trader.

- Trader’s Room/CRM:

Modern brokers typically offer a web service through a trader’s room, consolidating various trading tools in an integrated online interface. This is one of the critical elements of the brokerage business since the information about each client is stored on the broker’s website. This platform provides support for back-office functions, interacts with payment systems, works with document processing, and deals with the identifying of clients. CRM software for effective interaction with traders is often integrated into a trader’s room.

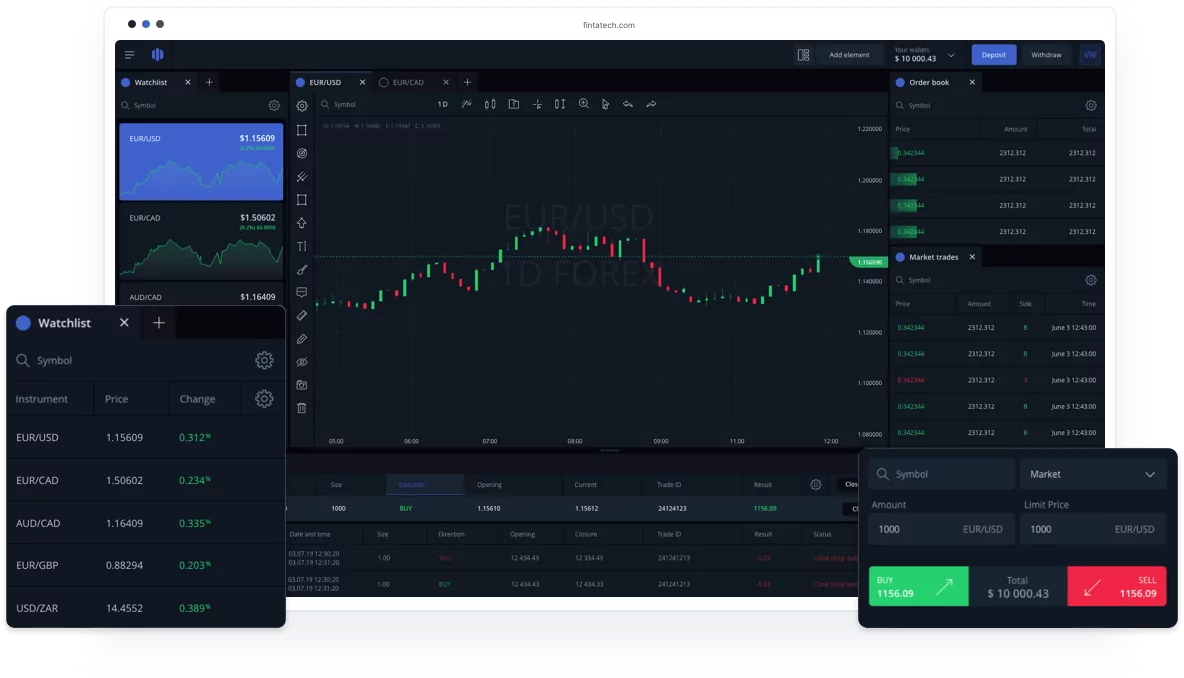

- Trading Platform:

This is the door through which every Forex trader enters, indispensable regardless of the trading style or favorite instruments. A trading platform influences almost every aspect of a trader’s experience: from access to primary market research to the performance of technical analysis on currency pairs. These platforms are engineered to ease the trading processes, provide ease in investment management, and offer opportunities in real-time, based on market conditions.

- Data Centers and Hosting:

Forex trading is one of the strongest examples in which solutions for hosting, such as VPS (Virtual Private Server) or VDS (Virtual Dedicated Server), are paramount to ensure that a persistent connection to the brokers’ servers is made. This is especially important in automated trading — data transmission at high speed, and reliability are crucial for correctly implementing various trade ideas. This kind of program automatically supervises the situation on the market, analyzes price changes, and determines the optimal entry level for transactions; it therefore realizes trading in a more efficient and less broker-reliant way.

It’s all these components that are essential for a functional and efficient Forex brokerage to make sure that traders are effectively being supplied with everything needed to trade effectively.

Step-by-Step Guide to Launching a Forex Brokerage

So now we have gone through the definition of what a Forex broker is, key features of Forex trading, and covered basic technical infrastructure, let’s see how one can start their own Forex brokerage. In general, there are two ways: you either use White Label/Turnkey solutions or start from scratch. Below, we outline the steps involved in establishing a brokerage from scratch.

- Defining the Target Audience

Successfully launching and growing an FX brokerage requires analyzing competitors and defining your target market. Factors like your customer’s age, gender, hobbies, income level, and country of residence will influence many elements of your business, such as your company’s legal address, marketing strategies, and the languages available on your platform.

- Registration and Licensing

Before starting the Forex business, it is essential to register your company and acquire licenses for running it. Licensing has much significance in the eyes of traders before choosing a broker. Various governmental regulators provide licenses depending on the size of the business, budget, and other parameters. The selection of a regulator influences not only compliance but also credibility for a brokerage.

- Budgeting

Explain your initial and ongoing financial obligations required to start and then replicate your brokerage successfully. That is, operating capital and budget for future expenses once successfully launched.

- Partner with a Reliable Liquidity Provider

For Forex brokers, particularly those operating under the STP model, it is crucial to partner with robust liquidity providers. These are usually large financial institutions or banks that help to ensure the broker can offer competitive pricing and liquidity. Some brokers also act as market makers and provide the necessary liquidity by being the counterparty to trades.

- Get a Powerful Payment Processor

Payment processing is vital for managing client deposits and withdrawals. Select only those PSPs that provide services in the geographical regions you are targeting and they support all payment methods. Experts strongly advise getting into agreements with several PSPs to guarantee business continuity in case one PSP fails to provide services.

- Building a Website

This is the first point of contact with traders. Your website has to be attractive, easy to use, and informative about the services provided. If web development is not your strong suit, consider paying to get a high-quality website developed.

- Select a Trading Platform

The trading platform is critical as it represents the primary means traders gain access to the markets. It should be easy to use and have at least the necessary trading and analysis features.

- Testing

Before the launch, test the platform thoroughly to make everything work in order and to identify all kinds of glitches at the outset itself. It is critical to take care of all the adjustments before going live. Make use of the feedback that gets generated by early users to keep on fine-tuning the platform.

Final Steps

After completing testing and refining the platform based on user feedback, make sure the platform operates seamlessly in the beta version. At this stage, it is also a suitable time to start marketing your brokerage to the targeted audience, which will put your full launch on the path to success.

All these steps will guide you through successfully starting and positioning a competitive financial market Forex brokerage.

White Label Solution: A Cost-Effective Way to Rapid Market Entry

The Forex white label solution, on the other hand, is a very cost-effective way of owning a brokerage company. The investment to set up a white-label brokerage typically runs anywhere from 15,000 to 75,000 EUR — far less than the expense of starting a business from scratch. This cost efficiency makes the currency market more accessible to a broader array of entrepreneurs and small business owners.

One of the most significant benefits of a white-label solution is quick time to market. A white-label Forex brokerage can be up and running within a few weeks — speedy market entry. It is essential that this quick set-up allows for capitalization of market opportunities and the time it takes to get a foot in the industry without going through the long delays building your brokerage would bring.

Additionally, white-label solutions facilitate operations by taking much of the technical and regulatory load off the brokerage’s shoulders, so the brokerage can devote its resources to service improvement and brand building, attracting and retaining customers. Even though the options for customization may be somewhat limited compared to those in a custom-build solution, most white-label platforms come with enough features and flexibility to help you carve out your own identity within the marketplace.

Conclusion

Launching and running a successful Forex brokerage in 2024 requires a deep understanding of the market’s dynamics, a robust technical setup, and a clear strategic vision. By following the outlined steps and adapting to the continuous changes within the financial markets, you can position your brokerage for success. As you embark on this journey, remember that each decision — from the type of broker model to the choice of infrastructure — will significantly impact your ability to meet the needs of your traders and thrive in the competitive world of Forex trading.

Twitter

Linkedin

Facebook